Indeed, I’m somewhat perplexed that it hasn’t already done so. Perhaps it’s just following a similar strategy to Volly (that has again postponed its launch – was originally 2011, now sometime in 2013) and not launching until it has a critical mass of billers and customers on its solution already?

It's definitely not following the Australia Post Digital Mailbox approach of “launching” by asking customers to register their interest for a later day.

Or Zumbox – which encourages you to register so that you can “immediately see which mail pieces will be available in your digital postal mailbox,” except there aren’t any.

Doxo has launched and encourages you to create a digital file cabinet and then upload scans of your important documents. Manilla goes one step further and wants to “manage everything in your life” (can you do the school run please?) Have I missed anyone out?

Is Google already the gorilla in the digital mailbox space?

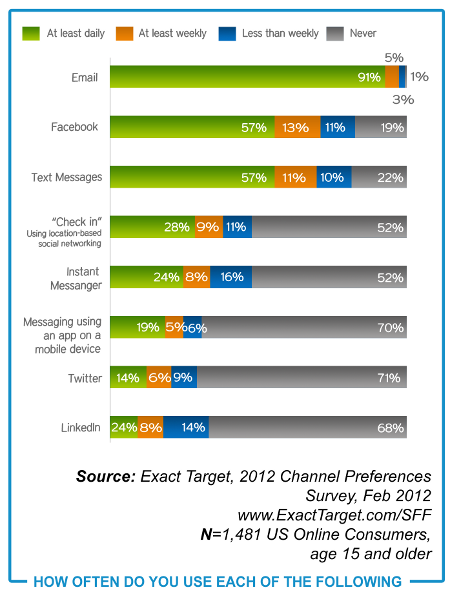

I think the main reason Google isn’t talking about this is that they do it by default already. They are my defacto Digital Mailbox. I get all my important documents on email already. I can move that email to a folder, forward to a friend or save the document to Google docs.

Here are a few of the benefit statements from each of the providers mentioned above- let's compare and see how Google measures up -

|

|

|

|

|

|

|

|

|

|

But it’s not actually any of the above that will make Google the winner in the long run...

The long tail of eBilling

Having your top five billers automatically insert their bills and statements into a digital mailbox would help drive paperless adoption, but it is just not possible to get ALL your bills there. And this is the reason that all digital mail consolidators will struggle against an open and easy to use network such as email.

It’s the long tail of billing that makes email statements and Google the sure winner...

- Your swimming teacher is not going to integrate with each portal – he/she is going to send you an email.

- Your town council will battle to do the integration – but they may already be able to send you an email.

- Your retailer isn’t going to give up the marketing opportunities in paper and email statements.

- Your bank isn’t going to put important documents into a digital mailbox that may be overlooked or just filled – but they will send you an email about it.

- Your child’s school isn’t going to integrate school reports into a digital mailbox – but they will email you.

If half my financial documents are mainstream and half are “long tail” docs which require a manual intervention, I’d rather just stick with my inbox which is a doing a great job as a consolidator already.

In fact, I bet that the #1 reason Google is the best entity for this kind of service is that they do it already – they just don’t really know it.

| 'You've got mail' |

Feel free to email us for more info – we’re all about the inbox at Striata!

Michael Wright

striata.com