I see myself as a pretty tech savvy person, but when something as simple as the background color of an application changed, it just did not “feel” right and actually affected my productivity. Now let’s not even talk about the fact that the buttons moved! I was a mess.

Is this how email users feel when they receive a regular email that’s undergone a radical new design and layout?

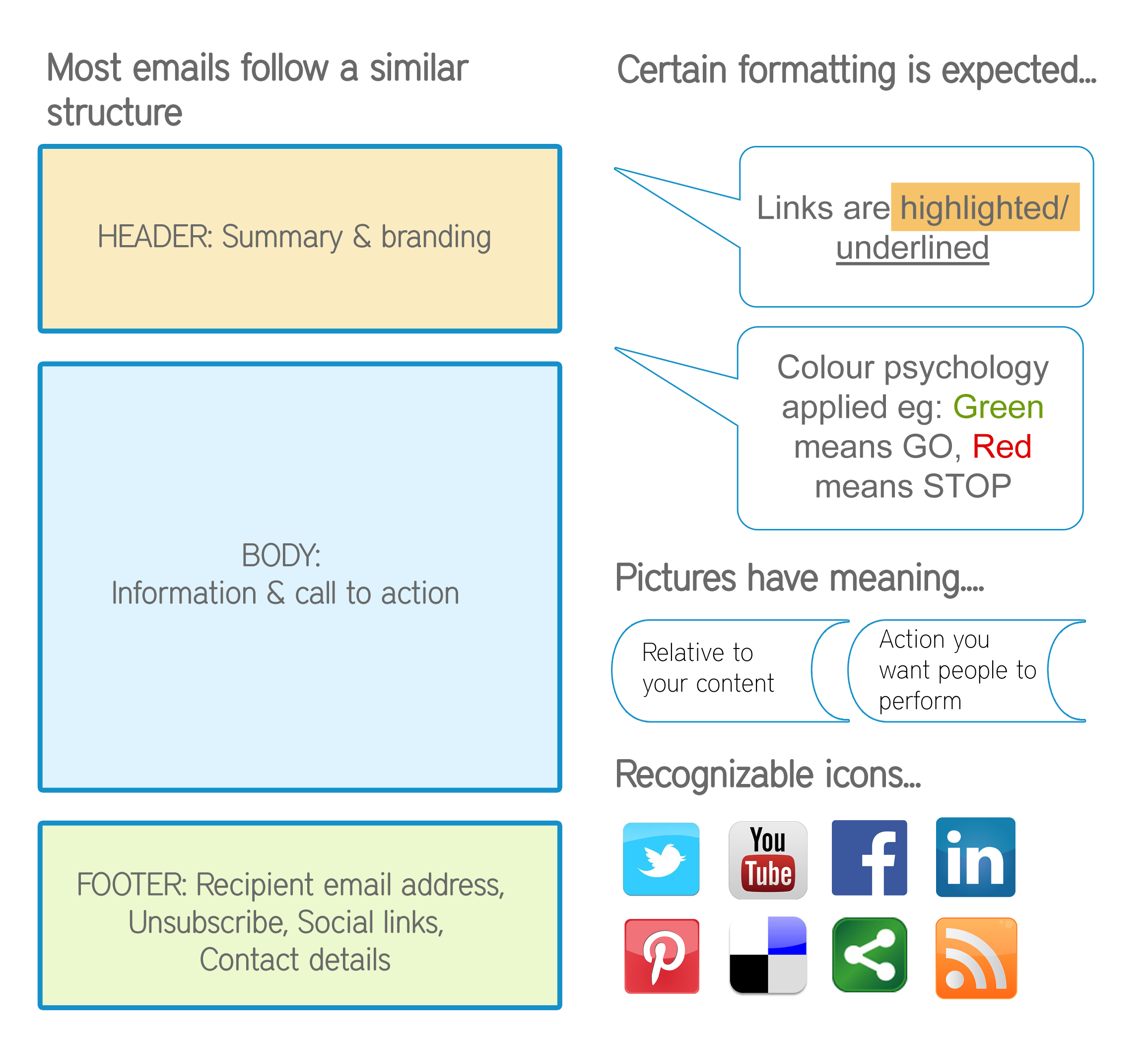

Stick to industry standards

Consider that some elements just work the way they are and email users expect them to appear in a certain way - based on other emails they receive.

So, if everybody knows what these mean:

Be creative but respect your brand

Give your customers the best opportunity to become acquainted with your brand by maintaining consistency on your website and across all your email communications, marketing collateral, transactional messages and eDocuments.And remember that branding also applies to your tone; keep it consistent across all your communications.

Test, test and test again!

Usability testing is essential and A/B testing is also great for testing at each stage of the migration if you believe the new idea is better. If you feel your current emails are not working for you, rather make subtle changes and migrate slowly, than a 'big bang everything is new' update. If you are doing a rebrand or just revamping, email is a great channel to announce the change to customers, so they know what to expect.

Striata can advise you on all aspects of email, including layout, best practices, campaign ideas and deliverability - Get your emails right! Contact us or let us call you back

Linda Misauer

striata.com