(To get the background to the regulatory debate – read this article by Peter Streicher in which he explains how networks are currently managing inter-charge fees for SMS and how this may change.)

As an emerging market with a high penetration of mobile devices (both feature- and smart- phones), South African businesses have been particularly innovative in their use of machine-to-person text messaging across many different applications:

- Triggered communications – a notification based on interaction between a business and a consumer: such as one-time-passwords for eCommerce and online banking transactions; notifications aimed at combating fraud (confirming login or activity).

- Lifecycle notifications – a simple way to keep a customer updated on the status of their engagement with a business – such as status of your car service or couriered parcel.

- Marketing – new customer acquisition (used extensively by the insurance industry) or cross/up-sell of products and services to existing customers with a simple call to action.

- Data gathering – if the mobile number is known, SMS is a great tool to gather other customer and communication details. (We’ve used SMS very successfully to gather email addresses).

- Shortcodes – using inbound text messaging to conduct competitions and provide customer self-service options.

SMS also complements other channels - for example: promoting your email bills using SMS to maximise the success of your eBilling open rate. Sarah Appleby recently blogged about the positive “uplift in open rate when emails are preceded by a text announcing their arrival in the inbox.”

But how much of the innovation and rampant usage has been due to the way commercial messaging costs have been structured in this market?

Free to end user - a Big motivator?

Possibly the largest motivator for using SMS as a messaging channel has been the ‘free to end user’ model currently in play. While ‘who pays for the SMS? (the originating network or the terminating network) is currently under scrutiny; the consumer doesn’t pay to receive a standard SMS in South Africa.

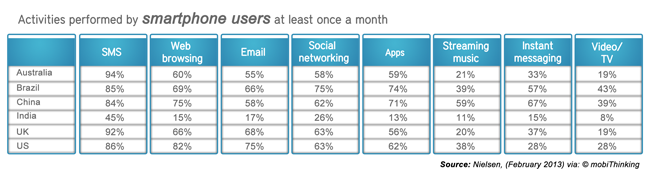

In the US market however, the recipient is charged to receive a standard text message, so the innovative application and the penetration of SMS as a channel is decidedly less. While a business can send a ‘free to end user’ text if they sponsor the recipient’s fee - the cost of this message type is so much more than sending an email, that it hasn’t taken off as an alternative channel.

What will happen to messaging innovation?

The current pricing debate is around how the networks charge each other and whether that charge should be regulated. But will this regulation stimulate or stifle innovation in the text messaging space? Just thinking aloud...

Innovation will be stifled if:

Free to end user - a Big motivator?

Possibly the largest motivator for using SMS as a messaging channel has been the ‘free to end user’ model currently in play. While ‘who pays for the SMS? (the originating network or the terminating network) is currently under scrutiny; the consumer doesn’t pay to receive a standard SMS in South Africa.

In the US market however, the recipient is charged to receive a standard text message, so the innovative application and the penetration of SMS as a channel is decidedly less. While a business can send a ‘free to end user’ text if they sponsor the recipient’s fee - the cost of this message type is so much more than sending an email, that it hasn’t taken off as an alternative channel.

What will happen to messaging innovation?

The current pricing debate is around how the networks charge each other and whether that charge should be regulated. But will this regulation stimulate or stifle innovation in the text messaging space? Just thinking aloud...

Innovation will be stifled if:

- The price charged to the commercial sender increases once the interconnect fee is regulated.

- The pricing structure becomes too complex to calculate in a budget.

- The networks pass some of the price restructure onto the recipient (making ‘free to end user’ a premium message cost).

Innovation will be stimulated if:

- The price per commercial SMS goes down after regulation. There’s nothing like a cost saving to encourage increased activity and creative thinking.

- The regulation levels the playing field and all players become equally able to innovate.

Personally, I’ll be watching this space with eager anticipation as there are so many great applications (as mentioned above) in our business of the simple text message.

Hopefully we get clarity in the next couple months, but whatever the outcome - have you considered the impact of a pricing change on your communication strategy?

Want to discuss further? Get in touch!

Hopefully we get clarity in the next couple months, but whatever the outcome - have you considered the impact of a pricing change on your communication strategy?

Want to discuss further? Get in touch!

Michelle van den Berg