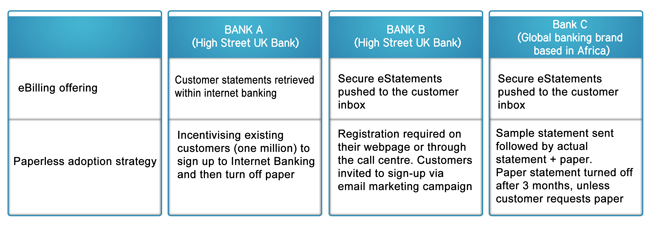

Here's a reminder of the three projects:

The Interim results

Bank A:

This project was over before it began. The web portal team took over the project and didn’t want any interference with their current model – potentially due to personal incentives. Apparently, less than 5% of the one million customers have signed up over the past 5 months.Comment:

- Results are predictable as most of the customers wanting to use Internet Banking already are.

- Each incremental percentage adoption is harder than the last.

Bank B:

Sign-ups are disappointing, with around 2% of the targeted customer base going through the three page registration process.Comment:

- Although there are consistently hundreds of customers opting-in each day, it falls far short of the thousands required to meet expectations.

- It highlights how critical the on-boarding process is. If you have barriers to adoption at the beginning, then it doesn’t matter how compelling the offering is, customers will drop off in droves at each barrier.

Conclusion: Cut through the adoption barriers by offering a registration free paperless process - a simple opt-in via email.

Bank C:

The results are very impressive. Just under half of the initial on-boarding emails are opened and over 85% of customers choose eStatements. A simple YES and NO button has forced people to make a choice rather than just do nothing. Customers in month’s two and three are also opting for Push eStatements, driving the total to 53% of customers (with an email address) turning off paper.Comment:

- Fantastic results – more than expected and on track to convert 50% of their customer base to eStatements within 6 months.

- This has the potential to be a world leading case study for paperless adoption of bank statements when it has run its course. And the long term prognosis is even better as the program keeps running for both old and new customers.

Conclusion: The moral of the story is simple – to move the paperless dial you need the right model – but even that can be negated by a bad customer journey.

The good news is that we have a case study for the perfect paperless adoption process – come chat to us about making it work for you .

Michael Wright

striata.com