It's all about big data, loyalty & new collection strategies in Asian utilities and finance

It's conference season in Asia, and I've been over in Singapore twice in the last month for the Utilities Revenue Management and the Cards and Payments Asia Conferences. It's always a great opportunity to find out what our potential customers are talking about.

6 topics that are trending in utilities and finance, and what we have to say about it:

- Big data is big news: In both utilities and the financial industries, analytics are being shared with the end-customer, rather than only being used internally to drive maximum revenues.

We say: With email Billing, detailed graphs of usage - be it electricity or credit-card - can be incorporated into the document, allowing customers to manage their own finances.

- Pricing trumps loyalty: In Australia - probably the most competitive market in Asia Pacific - price is King! Customers will switch providers every year to chase a perceived saving, and loyalty is very hard to find. Across Asia, suppliers are looking for innovative ideas to provide customers with added value beyond a lower price in hopes of reducing churn. Perhaps, information is again the key?

We say: Information in the bill such as graphs of current supplier vs industry average pricing is a great way to build relationships with customers. Also, engaging in more frequent value added communications will nurture the relationship. Educating customer s on how to minimise consumption for peak/off-peak tariffs goes a long way to establishing brand trust. Or how about a simple payment reminder text / email - it's a win-win for both customers and suppliers alike.

- Writing off millions in debt is 'just business', or is it? The range of bad debt and collections issues raised was immense! From the understandable need to manage DSO and late payments in Australia, to the situation in South Asia where some electricity suppliers are only getting paid for 55% of the electricity they generate!

45% losses are not uncommon in Pakistan, where theft, fraud and corruption combine to create an unsustainable circle of debt.

Privilege schemes offering discounts for early and regular payments, and "pay and win" incentives to encourage payment in predominantly delinquent areas are being introduced to good effect.

In other countries, bad debt that was previously written off is being looked at very carefully.

We say: The need to work this debt internally using low-cost channels - email and text - is being understood and recognised as a very effective way to increase collections. Simple reminders and late notices incorporating payment options can dramatically improve collection rates.

- Customer communications is all the rage: In countries where demand often exceeds supply, regular, timely communication is key in keeping customers satisfied.

We say: Low cost communication channels will play a critical role here in keeping customers updated and engaged. An email or text explaining why an outage has occurred costs less than 1c, whereas dealing with a single customer complaint costs many dollars!

- Credit Card payments are being introduced: In an industry that traditionally called customers "ratepayers" as they were seen only as a revenue-stream, things are finally changing and customer-friendly payment options are being introduced. A major electricity supplier in Malaysia negotiated a reduced fee with Visa/Mastercard and is introducing the facility for customers to pay using credit cards. This seems to have struck a chord as it wasn't the only utility I spoke to that are looking at introducing credit card payment options for late-payers and bad debtors.

We say: Much better to accept a 2.5% fee and get your money now, than hold off for some form of cash sometime in the future (and perhaps write-off or sell the whole debt).

- Smart Meters are here, but will benefits remain locked? In Australia there are already hundreds of thousands of smart-meters, and elsewhere in the region, they're on their way. Many regulators worry about the cost of these new meters being passed on to the consumer, and cite little evidence that they'll allow customers to manage their electricity usage and reduce their bills.

We say: Major studies in the USA1 show that regular communication with the customer the cornerstone to success here, with important lessons being:

» Educate customers before deployment of meters

» Create FAQs to answer questions before they're asked

» Communicate continuously on ways to shift usage off-peak

» Create authentic customer testimonials from early adopters

The good news is that all of the above can be facilitated by low-cost communications channels.

While paper/post and call-centres have been the traditional means of communicating directly with customers (never rely on them to visit your portal!), the pervasive use of email and text messaging amongst utility and banking customers means that these channels have become affordable and highly effective. This enables nice-to-have communications like payment reminders (before the due date) and mid-month high-consumption warnings (for utilities or credit-cards).

How effectively are you communicating with your customers? If you'd like to discuss some ideas, get in touch here ...

References:

- Intelligent Utility Magazine Mar/Apr 2012 - "Four Utilities Leading in Customer Service"

Keith Russell

striata.com

Two out of every three people that 'walk' into your 'online store' will shop around, select items to buy, add them to their basket and proceed to checkout. Then just as they pull out the credit card, they dump the basket by the digital door and leave!

This is the statistic that really grabbed my attention: the average documented online shopping cart abandonment rate is 67%! 1

Online store customers can be split into four groups:

- The 33% who have bought from you already

- New customers who have not yet visited your online store

- Those that have browsed but never check-out

- Those that reach checkout but abandon their baskets at the door, unpaid

They dropped the basket, now what?

Groups 1 and 4 are the customers who would benefit most from targeted email marketing.

Group 1 are your traditional eMarketing customers to whom you can legitimately send targeted marketing as part of a customer lifecycle program, provided it's relevant and improves their experience with your brand.

Group 4 are customers with the highest chance of re-engaging if you act quickly and smartly. The action of re-engaging with a dropped basket customer is known as 'Re-Marketing'.

Why do customers abandon their carts?

Forrester shows that the 2 primary reasons are: "I am not sure I want to pay that"; and "I am not sure I want that yet", which tells us that abandonment doesn't mean the end of a sale.

How will re-marketing help?

While some studies show that only 8% of abandoners will return to complete the purchase on their own, this number goes up to 26% with re-marketing according to SeeWhy.

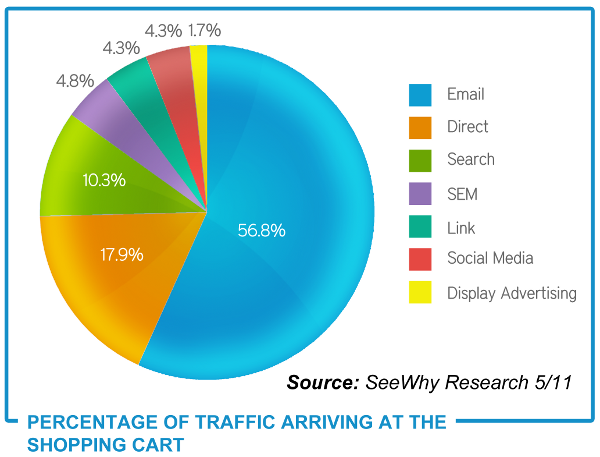

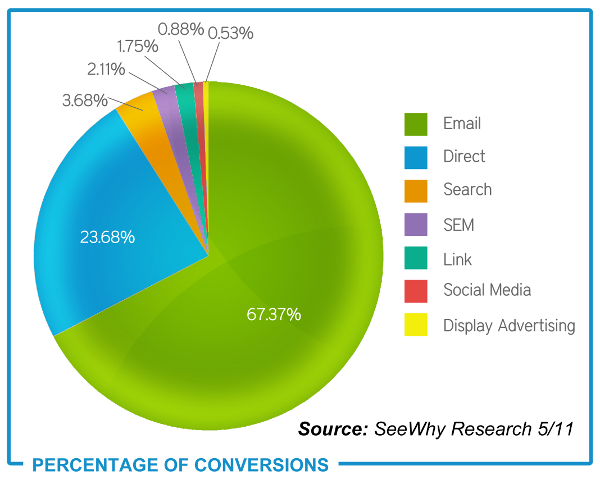

Let's take a step back and look at how online shoppers get to the cart originally. The SeeWhy graphs below show that 57% of traffic arrives at the shopping cart from an email; and 67% of cart conversions originate from an email.

It follows that if the majority of online shoppers get to the cart from an email, then email should also be the most effective channel to get them to re-engage. And it suggests that those that re-engage via an email are the most likely group to convert to purchase.

A report from Forrester Research stated that when re-marketed, customers were likely to spend up to 55% more. SeeWhy claims it is because of these 3 key factors:

- Re-marketing leverages off our emotions

- It induces a brand trust: because it's fresh in our memory

- Users then start to use the cart as an offline shopping cart, filling it up with every return to the site

What can I do to re-market?

Group 4 customers have one massive advantage from a marketer's point of view; they have registered and provided their email address (unless they are 'guest' customers). This is your chance to engage.

Once a customer has registered, there are a myriad of touch point and lifecycle communications that can be triggered. One of these could be a welcome series. This is the opportunity to educate them on your products and your processes. It also gives multiple opportunities to engage because as a 'welcome series' it can constitute more than one message.

Here are 5 key triggered communications to be used when a customer abandons their cart:

- An immediate trigger when their cart has been abandoned; ie within minutes send an email that reminds them that they have abandoned their cart. 2

- A second reminder a day or two later that references either the products they selected, or a key benefit of your site, like free delivery.

- A related [complementary] product mailer where you reference the product they had included in their cart and provide related or similar products that they may prefer.

- The consensus is that re-engagement will happen within 28 days, so within that time, a newsletter or a brief survey (2 - 3 questions) can be triggered that will speed up the re-engagement.

- Offer a discount or an incentive to return to the site.

Don't be daunted by that massive 67% abandonment rate because you can assist your customers along their decision path. The email channel is the perfect vehicle to re-engage your customers with relevant, targeted content that will inspire them to pick up the basket and pay for their goods.

References:

- The value is an average calculated based on 19 different studies containing statistics on e-commerce shopping cart abandonment. 19 Cart Abandonment Rate Statistics

- In a SeeWhy conducted A/B split test where they measured the impact of the send time for just the first re-marketing email, there was a dramatic difference in the total revenue recovered by the two re-marketing campaigns. The real-time re-marketing campaign generated 105% more revenue than the same email sent only 24 hours later

Simon Johnston

striata.com

Imagine these 3 scenarios:

- You received an email notification that your credit card bill is ready for viewing and payment online. You don't remember your password. Do you pay it? If so, when?

- Your water bill has arrived by post. You open it after a long day at the office. Do you pay it? If so, when?

- You're on your bank's portal wanting to pay your bill from your smartphone. You've tried your password three times and are pretty sure you just pressed the wrong keys. Now you are locked out. Do you pay it? If so, when?

This is real life. This is you as well as your customers. And I'd be willing to say that if we are all honest with ourselves, all of the above scenarios result in delayed or late payment. A very small and highly commendable group of people will answer "Yes, there and then".

Why self-service strategies, such as portals, aren't cutting it:

- People do not want to remember multiple usernames and passwords.

- Customers feel they shouldn't have to make all the effort to pay.

- Mobile in this day and age does not only mean geographical ease, but also instant gratification. Smartphones are making this all the more pertinent. Make your customers wait and they will go somewhere else.

Avoid delayed payments - 'Push' your customers' bills to their inboxes

The knock on effect of delayed payment is higher DSO and reduced liquidity, neither of which have happy endings in the world of business. And this is where PUSH eBilling comes in. PUSH eBilling sends your customers' bills to their inboxes. Tech in Asia, June 2012 recently quoted Aliza Knox, MD of commerce for Google Asia-Pacific "most people keep at least 1 mobile device within three feet and check it an average of 40 times a day". This goes to show that inbox delivery coupled with payment functionality from within this email or bill proves to be a heck of a lot of opportunities to drive payment at a very low cost.

But it isn't just about the technology.

Here are 5 Essential Steps to a Winning eBill Strategy

- Have a clear email collection strategy

#1 is truly number 1 ... there is nowhere else to start.

An email address is the gold standard of online communication. Without it, you will consistently need to resort to more expensive methods of communication, namely human intervention and post. There are many ways to collect customer email addresses. Ideally, it should be at every customer touch point, such as in store, call centre, via text campaigns, etc.

- Coordinate eBill with text messages (SMS)

eBilling is most successful when thoroughly integrated into your multi-channel strategy. Research shows a serious uplift in open rate when emails are preceded by a text announcing the arrival of an email in the inbox. Again, reduce the effort; make it easy ... let them know where to look!

- Use your analytics to silo customers

I am consistently surprised by how few collections and billing departments are using their expensive analytics to their full potential. Because PUSH eBills are encrypted and secure, they can be used for highly personalised communication. Why not send out a settlement offer instead of a bill to a certain customer segment instead of demand of complete payment? Isn't it better always to retain the debt than to sell it?

Whatever you do, don't sit on your analytics.

- Serve your cash customers within the eDocument

Maybe I've been around the block a few too many times but one thing I know for certain is that cash is NOT dead. Whether it's paying that builder or someone else there is a huge world of people that take their weekly salaries in the form of paper notes.

These customers can be the hardest to convert to paperless. Some of your more tax abiding cash customers will deposit the cash and then pay by card. However, a tremendous amount will prefer to pay via a cash payment terminal such as Paypoint or Payzone. In order to do that, they are provided with a barcode, on their PAPER bill, which they then take to a till and pay with cash.

Incorporating these barcodes into your eBills is a fantastic way to allow your cash customers to go paperless. Without this, they will probably never turn off paper.

- Automate, automate, automate - follow up with a direct debit campaign

Whilst eBilling can drastically reduce billing costs and DSO, it by no means promises more payments… or can it? Direct Debit is something many customers enjoy, but the process of signing up is often cumbersome. Why not send out a targeted Direct Debit campaign to ask for eConsent, directly from within your email bills? This is the holy grail of self-serve.

Quite simply, in order to get the most out of eBilling it is important that you not only rely on technology to create magic. That's only half the battle. Strategic roll out is the other.

If you want to know more about the 'PUSH' eBilling advantage and how to implement a winning eBill strategy, then let's chat!

Sarah Appleby

striata.com