Source Pew Internet 2009©

So if this is the case, then why is it that 75% to 95% of Internet Bankers still receive every paper statement and document that they did before the internet?

The answer is astoundingly straight forward – there is simply no incentive / compelling reason for them not to.

From a Jan 2010 Javelin report: “At least 7 out of 10 consumers receive paper statements – and a significant number are “double-dippers” who receive both paper and electronic statements.”

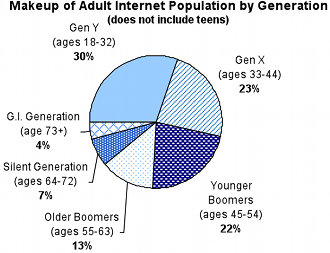

Every major bank has tried in vain to compel, entice & incentivize their customers to give up paper. Considering that 75% of North Americaninternet users are below the age of 55, and just on 90% of that group have home broadband access, the answer must lie in the customer experience.

Before we talk customer experience, let’s look at what I refer to as the“incentive disconnect”. For the customer, a once-off incentive of $10 may just be enough to get 30% of them to agree to turn off their paper statement. The current average hard cost (printing, envelope, postage) of mailing one paper bank statement is approximately US $0.50. By including marketing costs, a customer would need to be paperless for 24months for the bank to break even. So, financially, this is not a feasible option.

The consumer experience examined:

Today, with Internet banking, consumers can download PDF versions of their statements easily and quickly. This brings us back to our burning question – if this easy option exists, then why do more than 80% of US consumers still receive paper statements?

The answer comes down to 4 reasons:

- Current convenience: "I don’t have to do anything to get my bank statement"

- It’s an effort: The consumer has to act in order to turn off the paper. In most cases, the action required is a multi-step website navigation process – find the correct webpage within internet banking, navigate through very intimidating legal language and check multiple boxes (each with its own legal warning of some kind). All this to save the bank some money? Ask yourself, who would actually do this? The answer – only 5% to 10% of extremely tech savvy consumers will.

- Keeping records: Consumers have been educated to keep their bank statements. Even though banks do offer a multi-year history online, most feel that it’s simpler to just file them (in many instances, unopened) when they arrive.

- No incentive: There is no real compelling reason why consumers will elect to go paperless. ‘Why should I when I can have the best of both?”

So what will work for the consumer? Logically it has to be a strategy that includes all of the following elements :

- The consumer does not have to do anything to go paperless.

- Going paperless is more convenient than not. The proof – will it take me less or more time to open my electronic statement than the paper one? (If it’s more than 5 seconds, it’s too long.)

- Their statement is delivered to them - they do not have to go and find it and it can be read with just a single click.

- It is delivered in such a way that it can be opened and read both on a computer and mobile device, without any technical knowledge, special software etc.

- It must be more secure than paper delivery and can be saved securely with just one click.

In conclusion – until financial institutions adopt secure electronic document delivery , paper statement suppression will remain an elusive goal.

Garin Toren

Chief Operating Officer

www.striata.com

No comments:

Post a Comment