It stands to reason you’ll overlook, ignore or discard generic messages about products or services you aren’t ever likely to use. This is most certainly the case when it comes to email marketing , which is not only competing for a customer’s attention against other brands, but also trying to stand out through the clutter and spam.

Is your message getting lost in the noise?

Consider this: an estimated 88% of emails sent in 2009 were spam messages. So, your email marketing campaigns need to speak to the consumer on a personal level. Now is the time to change. Everyone is receptive to information about things that specifically interest them and in fact, rather than merely tolerating that sort of information, it is the sort of thing they actively seek out.

It’s about being relevant, to get your email marketing messages not only delivered, but read and actioned by your customers, you just have to start being relevant to them again.

Consumers are asking: do you understand me? Do you know what I want? Do you care to get it to me in the way that I want it? If you can answer yes to these sorts of questions, you have a real chance at gaining that consumer’s attention.

If you do not, you’ll struggle to gain readership for your messages and may see your unsubscribe rates begin to climb.

What you need to bear in mind:

- Listen to your customers: ask them what information they want to receive by posing questions that determine their life-stage and interests, right at the start when they sign up for email marketing. They’ll tell you what they’re interested in or want to buy if you care to listen to them.

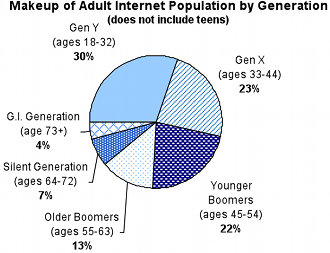

- Segmentation and targeting: start segmenting your customer base, not only on their interests, but also on their purchase behaviour, demographics, life-stage, activity on previous emails and activity on your site. Then you can start targeting messages that are relevant to each customer, based on all the information you have in their profile.

- Content: make sure what you’re sending to them matches their interest. This is about what they want, not what you want to send them. Get this right and you’ll grow a willing and interested reader base.

- Timing: think about the optimal time to send your messages. This will depend on your audience and their daily and weekly habits.

- Using the right channels: what’s best, email? SMS? Something else? Know your audience and how they work and you’ll significantly increase your chances of reaching them.

The right content, at the right time, using the right channels and all based on customer feedback will enable you to be relevant to the target audience for your products or services. In the end, that’s the ideal position for a marketer to be in.

Mia Papanicolaou

Head of eMarketing

www.striata.com