The downside of this arrangement is that I am left with little choice. Sure, I get to say “yes” or “no” to a product that comes my way, however I rely heavily on him pushing this information to me. I never hear directly from any of the companies who underwrite these products. Come to think of it though, it’s been several months since I heard from my PFA.

Why the ‘middle man’ is an obstacle

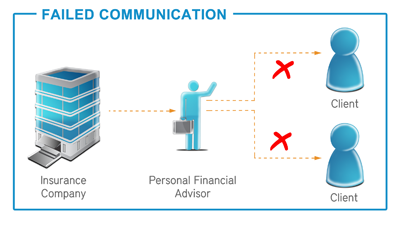

As a traditionally intermediated industry, a great deal of insurance business is done through third party brokers and PFAs who play a ‘middle man’ role between the product owners and their end customers.

The result is often a crippling communication void between the insurance companies and their policyholders which, in many cases, is nurtured by the ‘middle man’ to retain control over access to the customer.

I understand why. The broker / PFA fears being left out of the loop. In fact, in some instances, intermediaries block the communications sent to customers by setting up multiple mail boxes (for traditional and electronic communication) to ensure only what has been vetted by the PFA is sent onto the customer.

So, what’s the solution for a consumer like me who wants targeted, relevant information to assist in making wise financial choices? The answer is to develop a solution for the companies who create the products, that allows them to communicate effectively with the people using their services.

Communication strategies that are win-win-win

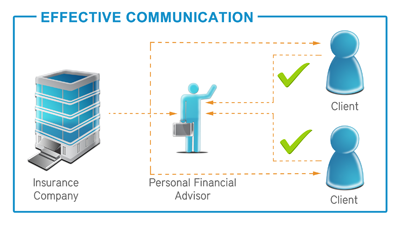

Introducing a strategically inclusive communication plan can benefit all parties. The argument about who owns the customer becomes moot when the insurance company works alongside the broker or PFA to present appropriate products to the end customer.

It is possible to create digital communication strategies that effectively communicate with policyholders, while maintaining the important relationship between the broker and his customers.

There is fantastic flexibility in digital communication which enables agile segmentation and targeting of communications. The outcome is a relevant communication that the customer receives from their broker, allowing them to take up the offer or request further information from within the email (the information request is on sent to the broker). Customers are also kept up to date with the latest products that cater to their individual needs.

Using interactive digital marketing helps bridge this communication gap via a three way approach that markets an insurance company’s product offering on behalf of a broker to a customer. Everybody wins in this scenario.

Nicola Els

striata.com

No comments:

Post a Comment