I attended a

retail banking conference recently, where the conversation surrounding

customer service was more present than I ever could have imagined. I’m

no cynic, in fact, I don’t even dabble much in sarcasm but the sincerity

of the conversation surprised even the Candide in me.

Financial institutions not only want deposits but also customer attention. They take pride in net promoter scores

and use them to swagger at these industry events. By slicing and

dicing customer data, they are able to tell the right customers about

free coin counting machines, public restrooms or doggie treats in

branch. Some financial institutions feel it’s their USP and the reason

that each customer is going to feel cared about. And I am dead serious

about these offerings; I listened to a great speech by First Direct

about those very services.

That said, Big Data was proposed to hold the secret to excellent,

personalised customer service, perhaps even more than doggie treats. The

idea is: take Big Data, analyse it and create the perfect one-to-one marketing message.

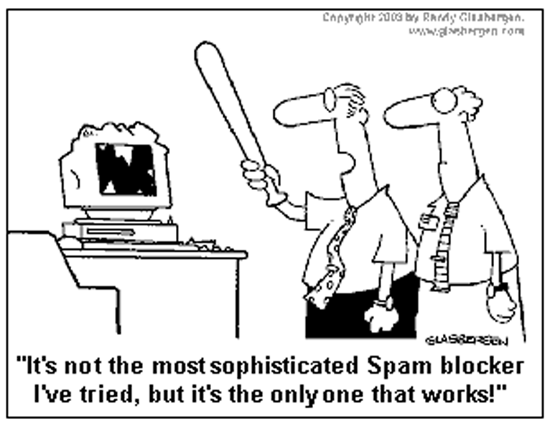

Sadly for most financial institutions, the next logical step after

analysing their Big Data and creating the message is often not

considered. It is hard to imagine investing millions in cultivating Big

Data to the point of personalised messages only to send the sweet

creatures off to the spam

slaughterhouse. As much time and attention should be given to the

delivery of the message as is to data collection and analytics. If not,

much of the investment is lost.

You’ve got the perfect message, but you’re caught in a trap

The fact is that 20% of legitimate batch email is delivered straight to SPAM

folders which means a lot of lost investment, a lot of lost

opportunity. I don’t care if you are a hegemon, a mom and pop shop, or

whether or not your customers have consented to being emailed. Unless

you use a specialist email supplier with a credible sender score, your emails are at risk of never being read.

As volume plagues inboxes, SPAM filters are becoming more and more

sophisticated in order for ISPs to protect customers from sheer

harassment. I am personally an advocate of these filters increasing in

sophistication, as I recently missed an email from my Mom in the jungle

that is my inbox. Sorry Mom, I did love the biscuits, thank you.

Don’t lose your one-to-one marketing messages to the ISP sieves that are becoming increasingly finer.

Marketing messages and the lost touch point

While most financial institutions have their eyes on the prize of

cutting paper and postage costs, the paperless replacement is often an

untouched space. I am a customer of Orange and was defaulted to

paperless statements, meaning I had to make an effort to log on to the

portal to see what’s what every month. After I signed up for Direct

Debit, I never made that effort (except after an unfortunate use of

Google maps in Paris which shocked even the likes of me). I had no need

whatsoever to log on to the portal and therefore, any Marketing

Messages they hoped to get to me as a customer have been lost.

Remember that getting into the inbox is everything when it comes to extracting the value from Big Data and personalisation.

Big Data is only big business when it results in big revenue, and to get that you need to get the message through.

Use a specialist email provider to GET THERE - keen to know more? Then get in touch!

Sarah Appleby

striata.com

No comments:

Post a Comment